|

Last week I received the annual list of America’s 100 largest retailers published in Chain Store Age Magazine. As a list lover, and in particular a retail lover, this is always of great interest to me.

The retail list is probably as dynamic and ever-changing as any “top company list.” Of the ten largest companies which I will touch on here, only two would have been in the list 30 years ago. Today’s retail giants are rarely tomorrow’s.

It’s no surprise that #1 on the list is Wal-Mart Stores, with $405 billion in 2008 revenues and 7873 stores at yearend. These numbers include all their international operations and the big Sam’s Club operation.

#2 was Kroger, the biggest supermarket chain but not the biggest seller of groceries – that’s Wal-Mart. Kroger did $76 billion in sales and had 3550 stores at yearend. Kroger is one of the two companies that would have been on this list 30 years ago, the other being Sears (see below).

#3 this year was Costco, passing up Home Depot which had a down year. With “only” 512 stores, Costco generated $72 billion in sales, a remarkable achievement.

It is not surprising that the top three companies are all food merchants — which has been a giant industry in the USA for a long time – or general merchandise stores – or both (like Wal-Mart’s supercenters and all Costco stores). Both the supercenter – combining groceries with general merchandise – and warehouse club stores (like Costco) are innovations of the late 20th century. These innovative concepts did not become widely successful until the last 20 years.

The first Kroger store opened in 1883 (in Cincinnati) but these other concepts did not come along for another 80 years or so. The first Wal-Mart opened in 1962 (and their first supercenter much later) and the first Costco opened in 1983 (preceded by the 1976 invention of the warehouse club concept by the great Sol Price).

#4 on the 2008 list was Home Depot, with sales of $71 billion out of 2274 stores. That makes Home Depot the largest specialty retail chain in America, and likely the world. This is an awesome achievement – to take one very limited category of merchandise and build such a huge business out of it. Despite some setbacks and management changes in recent years, this company is still one of the greatest stories in American retailing.

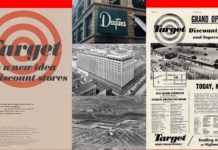

#5 is one of my favorites, Target, with almost $65 billion in sales and 1682 stores at yearend. This of course makes Target the #2 operator of discount department stores, albeit at a long distance behind Wal-Mart. Target is one of the great stories of American industry – not just retailing – because it represents an old company that saw the future and successfully did a complete corporate makeover.

Originally this was the Dayton Company, a traditional department store from Minneapolis. In 1962 they opened the experimental Target stores to create an “upscale” or “fashionable” discount store. They did a lot of other experimenting and acquiring as well, starting with a merger with Detroit’s giant Hudson’s department store (and renaming the company Dayton-Hudson), then creating B. Dalton bookstores, and later buying Marshall Field’s and Mervyn’s. It took many years of trying, some of them very disappointing, to make Target successful. Most other companies that tried starting discount stores gave up. But these folks stayed with it.

Eventually, they created the only big viable competitor to Wal-Mart, they sold off all their other divisions, including the Dayton’s “mothership,” and renamed the company Target. Today, for the good of their customers and stockholders, they are focused on just this one business. It would be hard to find another US company which so successfully reinvented itself.

#6, the Walgreen Company, is my favorite retailer these days. I reviewed this great old company here: https://hooversworld.com/archives/2803. They did $59 billion in revenues last year, and ended the year with 6934 stores.

Right on their tail is arch-rival CVS, at #7 with 6923 stores and 2008 retail sales of just under $49 billion. The overall CVS Caremark company is actually much larger than this when you include their non-retail operations.

Both of these drug store chains are very well-run. Both are building stores on every good corner in America. And both are in a great position to benefit from our aging population and rising healthcare needs.

#8 was Lowe’s, another favorite company of mine. Lowe’s did $48 billion and ended the year with 1649 stores. For many years it looked like Home Depot might be the only surviving company in the home center or home improvement retail industry. Strong competitors like Washington’s Hechinger’s were dying like flies. But the much older North Carolina-based Lowe’s revised their whole strategy and took on Home Depot.

I think Lowe’s is a wonderful case of figuring out how to zig when your larger competitor zags. By carefully studying Home Depot and the bigger company’s Achilles heels, Lowe’s was able to develop stores which were differentiated and in many ways superior. They were better lit, better signed (internally), had deeper expertise in higher end product areas, and were more friendly for women shoppers, among other innovative attributes. While Home Depot has come a long way in responding to some of these innovations, Lowe’s is still a better merchant in my book, and continues to give the big guy a run for their money. This zig-vs.-zag idea is also the key to Target’s success in competing with Wal-Mart.

#9 on the list, Sears, is the one other company that would have been on this list 30 years ago, but they would have been first or second – alongside the Great Atlantic and Pacific Tea Company (“The A&P”). And this Sears of today also includes the old Kmart company, which also would have been at the top of the list 30 years ago. So here we see two former leaders combined into one company, which continues to drop in the rankings.

I think both Sears and Kmart are two of the saddest stories in retailing. Both companies were formerly great retailers. Sears was undoubtedly the greatest. It was built by three successive visionaries – Richard Sears, Julius Rosenwald, and Robert Wood. It morphed from a mail order company to a retail company, and tacked on a hugely profitable insurance business (Allstate, since sold off).

While the combined company did a lot of sales last year — $46 billion out of 3918 stores – this was down $3 billion from the prior year. In my analysis, the company can be expected to continue to drop in sales. I think the current owner of the company, Eddie Lampert, does not have a clue about how retailing works. At one point called the “next Warren Buffett,” brilliant wheeler-dealer Lampert forgot one of Buffett’s key philosophies: find great companies and support the management team. Instead, Eddie started taking over losers, thinking he was smart enough to turn them around. As I have said elsewhere (https://hooversworld.com/archives/2963), just because you are smart at one type of business (in his case, finance) does not mean you can run any business.

But Sears was in bad shape before Eddie took over.

What went wrong? In my short analysis, Sears took its eye off the ball. It took its eye off the customer. It did not protect its fortress. It lost its “reason for being” in the eyes of customers.

30 years ago Sears was indeed a fortress in the world of retailing. It “owned” or “dominated” such critical growth categories as tools, auto parts, and appliances. These were great categories to “own” – look at the growth of Home Depot, Lowe’s, Auto Zone, and Best Buy.

Sears had by far the largest mail order operation in the world. What economists call “non-store retailing” – mail order, telephone orders, online orders – was just blossoming when Sears closed down its mail order operation.

Instead of protecting these valuable fortresses (through advertising, assortment, product innovation, aggressive pricing), Sears went off and built the world’s tallest building (which they later sold). They diversified into real estate brokerage (Coldwell Banker) and stock brokerage (Dean Witter). They invented the Discover Card.

They took their eye off the ball. They did not stick to their knitting. Simple as it sounds, I think that is really the essence of Sears’ fall from grace.

Once you begin ignoring your customers, then lots of other symptoms show up, from corporate extravagance to simultaneous expense cutting, including laying off your most talented and experienced (and therefore highly paid) employees.

Despite the efforts of several different managers brought in by Lampert, I have not seen much evidence that Sears has found a way to be meaningful again to the American consumer. They don’t have the prices of Wal-Mart, the fashion of Target, the tool intensity of Home Depot, or any other competitive strength that would be required to rise to prominence, or even survive.

The Kmart story deserves a separate post, but is best understood as part of the whole history of the discount department store business that they helped pioneer and build, but have now lost to Wal-Mart and Target. In its glory days, Kmart was another example of a company re-inventing itself. It migrated from being the #3 variety (“dime store”) chain SS Kresge (after FW Woolworth and WT Grant) to become the powerful #1 in discount stores (temporarily).

#10 on the list is a “baby,” Best Buy, with sales last year of $45 billion out of 3914 stores (many of them recently acquired European stores). Although founded in 1966, the company did not really begin to play a noticeable role in American retailing until the late 1980s. It was for many years an “also ran” compared to giant Circuit City, which is now bankrupt. Making money and selling consumer electronics – which continually drop in price – is a really tough act. Best Buy has done an amazing job, but plenty of challenges lie ahead.

In reviewing these top ten companies, some stats that I calculated popped out at me. I did not delve into each company’s annual report as I would do if I were doing more serious and time-intensive analysis, but just ran these numbers off those provided in the Chain Store Age article.

The largest sales gains were 12.6% at Costco and 12.5% at Best Buy. The latter may have come in part from acquisitions, but Costco’s was “organic” – either from old stores, or from new stores of the same type. Walgreen’s was next at 9.8%. The only losers were Sears and Home Depot, both down about 7.8%. While Home Depot may have cut back on some businesses and closed stores, their organic growth still trailed Lowe’s, which had a flat (-0.1%) year. Sears on the other hand appears to be in freefall.

In analyzing retailers, I believe many commentators underestimate the importance of per-store productivity. In other words, they look at the total sales of the company and say “look how powerful they are” but do not focus on the sales per average store. While total company sales can have a big impact on how cost-effectively you can buy merchandise and how efficiently you can run the company, there are also major cost savings at the store level.

For example, when I started my bookstore chain the average chain bookstore did about $500,000 per year in sales, and paid their store manager $15,000, or 3% of sales. Our stores did about $3 million per store and we paid our store managers $30,000, or 1% of sales. We were able to hire better, more talented managers at the same time we dropped 2 percentage points out of our cost structure! The same logic applies to one degree or another in almost every line of expense – rent, utilities, insurance, local advertising, etc.

That is huge in a business where you hope to make a profit of 2-5% on sales. I always considered any expense that was 0.1% of sales or more as a big thing to watch. If you pass such savings back to the customers, as great discounters often do, you usually increase your market share – which means your revenue – and achieve even lower expenses relative to sales.

All of which is a long way of saying that I am very interested in average sales per store. Total company figures like those calculable from the Chain Store Age data have limits – for example, Sam’s Club’s may run a lot higher sales per store than Wal-Mart’s but are averaged together here, yielding a company-wide sales per store that is not apples-to-apples comparable to Target. But these figures are a starting point in understanding what’s happening.

The winner in sales per store, on this basis, is Costco at $145 million per average store open during the year! That is an amazing figure. When Sol Price opened the first warehouse club, called Price Club in San Diego, I visited him to try to figure out how he could do $100 million in his third year when our stores – I worked for the May Department Stores Company at the time – were lucky to do $30 million a year after 30 years in business. And our stores were bigger than his (in square footage)!

The calculations show #2 in this regard is Wal-Mart (corporate average) at $54 million per store, followed by Target at $40 million, Home Depot at $32 million, and Lowe’s at $30 million. The drug store chains bring up the rear, doing a “measly” $7-9 million per store (in a much smaller space). Sales per square foot are another time-honored retail measure, which I could not figure from the data in the article. I have to add that Best Buy’s US operations – excluding their more recent foreign acquisitions – also probably do a very high sales per store.

As long as I’m writing about retailing, I have to mention one other company listed in the top 100.

I think J.C. Penney, listed #21 with $18 billion in sales out of 1093 stores at yearend 2008, may be “America’s most interesting retailer.” Of course I love history, and particularly retail history. Since early in the 20th century, Penney has been one of America’s great retailers. Founder James Cash Penney was one of my heroes.

When I worked on Wall Street picking retail stocks in the early 1970s, there were three giants which institutional investors preferred – Sears, Penney, and Kmart (then called SS Kresge). By the 1990s all three of these companies were old and tired and not doing well. The Boards of all three looked for solutions and sought new leaders. They often turned to financial wizards, or cut expenses. But only Penney was smart enough to know they needed a real merchant to turn things around. (I define merchant as someone who loves merchandise and who loves customers; a more traditional definition would be the topmost buyer, the person who picks the goods you are going to sell.)

When veteran department store merchant Allen Questrom arrived at Penney, he told Wall Street it would take a few years to turn things around. They laughed and Penney’s stock and bonds collapsed. But Questrom delivered on what he promised, the stock and bonds rose back up, and today Penney is a vigorous company – certainly a lot more lively than either Sears or Kmart. I think Penney could have a very solid future, now under Questrom’s successors.

With this great history, I have to root for Penney’s. And their stores give me reason to root. They are looking better every day, and are effectively competing with arch-rival Kohl’s, which is slightly smaller in sales and store count. I just bought a bunch of new clothes at Penney’s last week.

The second ten on the 2008 list are:

#11 Safeway – another old time grocery chain.

#12 Supervalu – an old grocery wholesaler with larger retail operations today. They took over a lot of the former Albertson’s chain, a once-great operator that fell victim to bad management.

#13 Rite Aid – a drug store chain whose life has been a roller coaster.

#14 Macy’s – this Cincinnati-based company resulted from the gradual combination of what were all the big old department store companies – Federated, May, Allied, Associated, Dayton-Hudson, Marshall Field’s, Macy’s, and several others. I worked for two of the predecessor companies in their glory days, back when they were the best places to learn retailing. Both Allen Questrom and yours truly learned our licks at the old Federated Department Stores. I think Macy’s, which dates from the mid-19th century, can survive another 100 years, although not as the dominant stores they once were. Macy’s now markets nationally under only a few brands, including Macy’s and Bloomingdale’s, and their 847 stores are mostly well-located and well-known.

#15 Publix – this outstanding privately-held Florida supermarket chain is one of my three favorites in the industry, alongside upstate New York’s Wegman’s and Texas’ HEB. (I do not consider Whole Foods Market as a supermarket chain.)

#16 Staples – has pulled ahead of rival Office Depot after years of battle.

#17 Ahold USA – European supermarket operator which owns several different names in the US, such as Stop & Shop and Giant Food (the one in Washington, not Pittsburgh).

#18 Delhaize America – another European supermarketer, with Food Lion and Hannaford Brothers in the US.

#19 Amazon – still a lot of upside!

#20 TJX Companies – TJ Maxx, Marshalls, and other stores; a major player in apparel retailing.

JC Penney follows up at #21 and Kohl’s is #22.

Note that there are a lot of supermarket chains in this list. However, 30 years ago the whole top 20 would have been dominated by supermarket chains. As people have shifted from eating at home to dining out, the supermarket industry has grown much more slowly than retailing overall, while the restaurateurs (not included in this list) have risen dramatically.

|